Automation Awaits: 1.6 Million Jobs Unfilled, Solutions Loom

By Maxine Shaw

1.6 million unfilled jobs—this staggering number could redefine the manufacturing landscape in the coming years. RobCo’s Roman Hölzl, fresh off their successful Series C funding round of $100 million, is positioning his company at the forefront of a robotic revolution aimed squarely at this labor gap.

The Munich-based modular robotics firm recently launched its U.S. headquarters in San Francisco, a strategic move to tap into the burgeoning automation market across manufacturing, construction, engineering, and healthcare. According to Hölzl, the results of their Automation Readiness Index survey of 400 U.S. industrial decision-makers reveal a pressing urgency: companies are grappling with significant labor shortages that could hinder production capabilities.

“More than 1.6 million jobs remain unfilled in the next couple of years, which poses a serious threat to operational efficiency,” Hölzl said. This revelation is not just a statistic; it highlights an industry in crisis—one that may not be able to meet consumer demands if the labor situation does not improve soon.

As automation continues to evolve, companies face decisive choices regarding capital expenditures. The survey findings show that while many organizations recognize the need for automation, there remain critical roadblocks. A lack of integration planning, insufficient training, and outdated infrastructure contribute to hesitance in adopting new technologies. It’s a familiar dilemma for plant managers: the promise of advanced robotics is enticing, but the execution often falters.

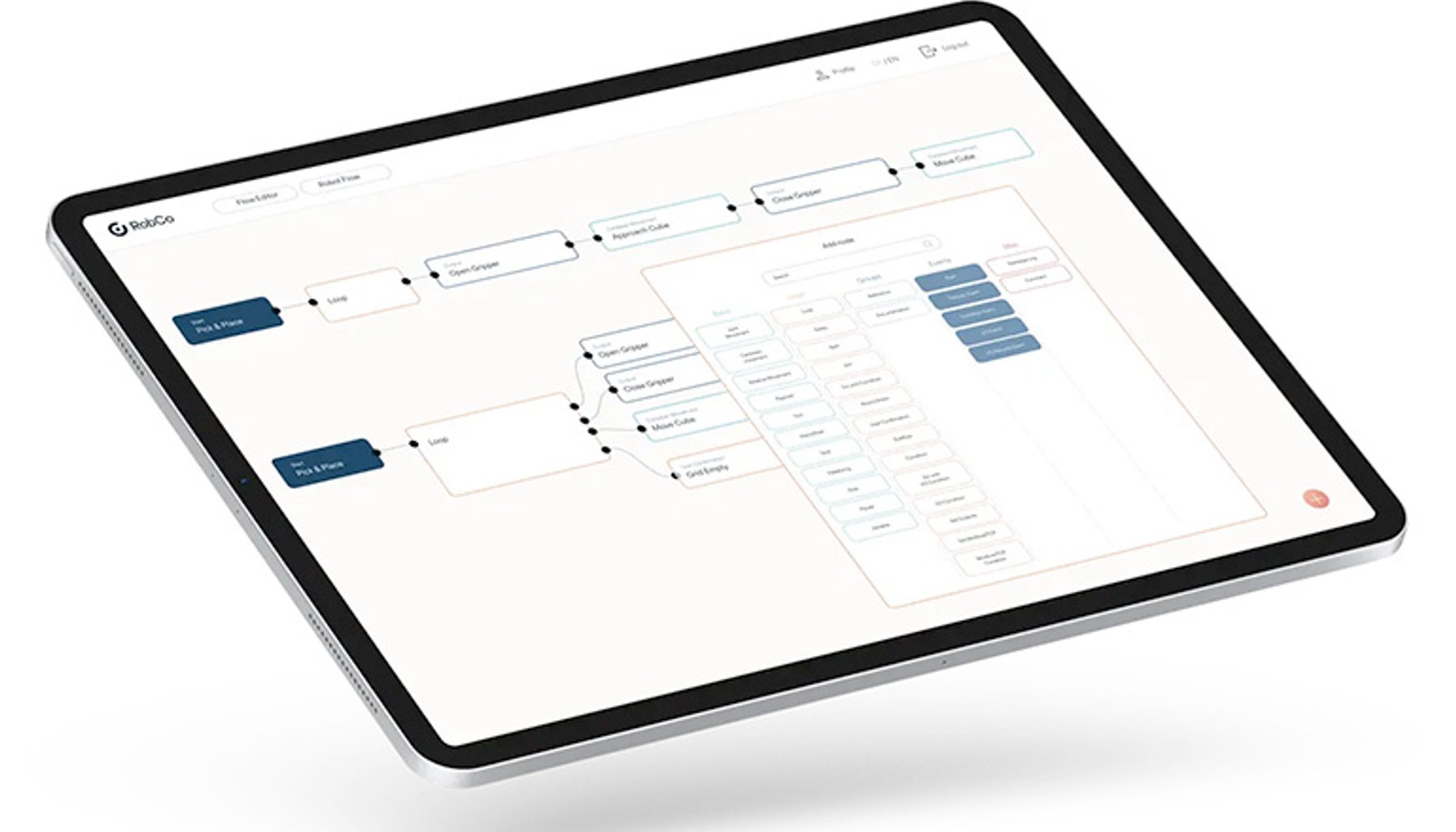

RobCo aims to address these challenges with its Studio software, designed to simplify robot workcell configuration and operations. This platform is vital for ensuring that automated systems can be deployed quickly and efficiently, a necessity when dealing with the constraints of existing factory layouts. In an environment where every square foot counts, the integration requirements—floor space, power needs, and training hours—are pivotal considerations.

The new funds will allow RobCo to enhance its physical AI roadmap and expand enterprise deployments. Integration teams report that the upfront costs of automation can be high, but the right platform can lead to significant cycle time improvements. For instance, a well-implemented robotic cell can drive down production times by as much as 30%, translating to shorter lead times and improved throughput.

However, success is not guaranteed. Floor supervisors confirm that while robots can take over repetitive tasks, human workers are still essential for complex problem-solving and tasks that require dexterity or judgment. This reality necessitates a balanced approach to automation—one that doesn’t just replace workers but complements their efforts.

Moreover, hidden costs are often overlooked in vendor discussions. Companies must be wary of additional expenses related to ongoing maintenance, software updates, and the training required to ensure that existing staff can operate and troubleshoot new systems effectively. It’s crucial to dissect vendor claims and build realistic budgets that account for these variables.

In the wake of these labor shortages, the industry is at a crossroads. As Hölzl puts it, “We are committed to automating the ordinary, so humans can do the extraordinary.” This vision could be the key to not just filling the employment gaps but also driving innovation in manufacturing. The numbers don’t lie; the urgency is palpable, and the path forward will require decisive action from both technology providers and industrial leaders.

With 1.6 million jobs hanging in the balance, it's clear that the future of manufacturing may depend on successfully navigating the intricacies of automation and human collaboration.

Sources

Newsletter

The Robotics Briefing

Weekly intelligence on automation, regulation, and investment trends - crafted for operators, researchers, and policy leaders.

No spam. Unsubscribe anytime. Read our privacy policy for details.