RoboSense Surges on Robotics LiDAR Growth

By Chen Wei

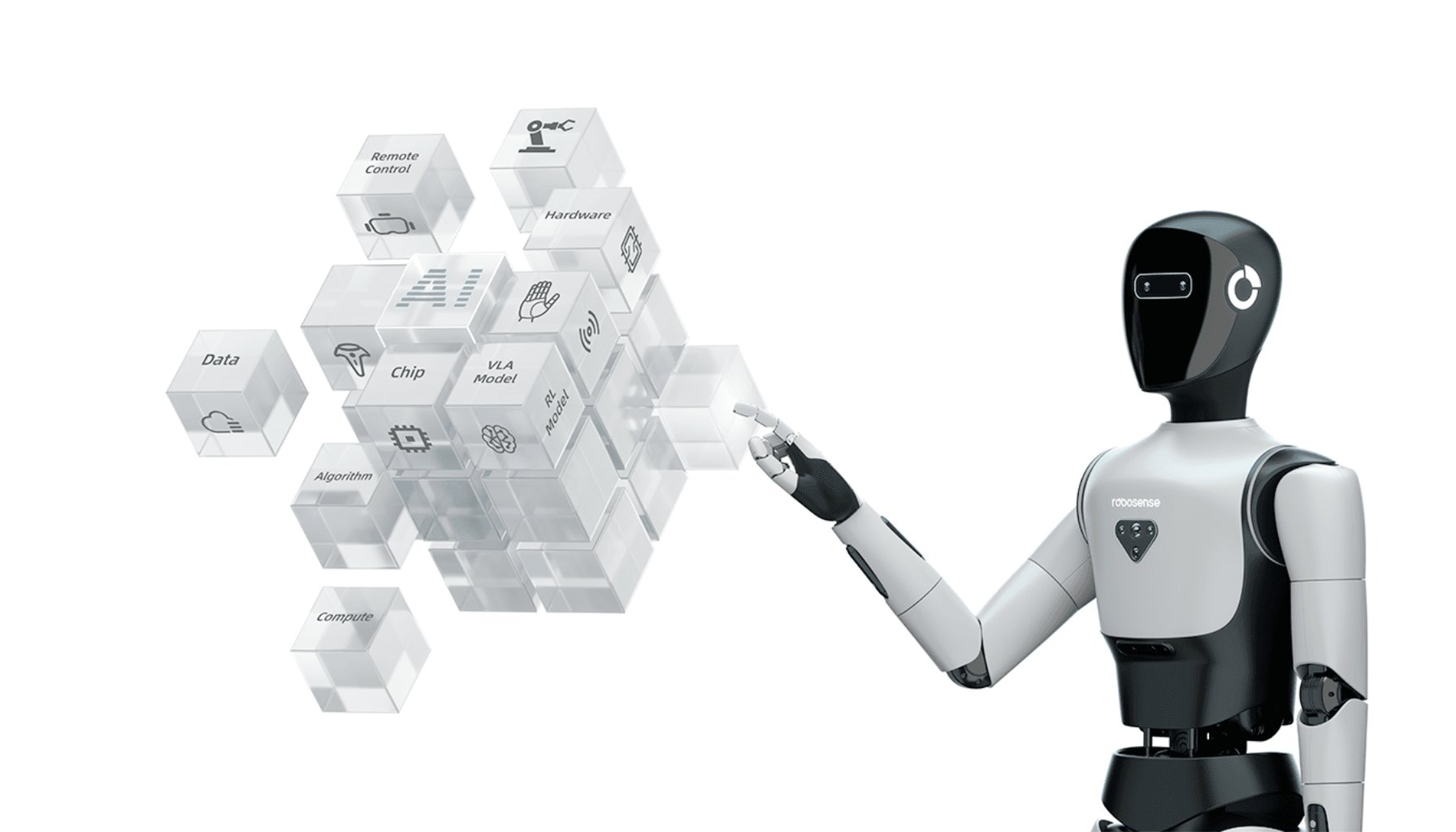

Image / pandaily.com

RoboSense forecast its first quarterly net profit as robotics LiDAR demand surged 1,142% year-on-year.

The Hong Kong-listed sensor specialist, ticker 2498.HK, said it expects a fourth-quarter 2025 net profit of no less than RMB 60 million, a turning point signaled by a year of accelerating sales across its robotics segment. In 2025, RoboSense reported robotics LiDAR sales of more than 303,000 units, a stunning leap from 2024, while total LiDAR shipments reached 459,600 in the fourth quarter, with robotics applications accounting for 221,200 units. That mix makes robotics almost as important to revenue as automotive-grade LiDAR, underscoring a strategic pivot from cars to factory floors, logistics hubs, and service robots.

The numbers reflect a broader realignment in China’s LiDAR industry as suppliers chase non-automotive demand. RoboSense has been expanding beyond its traditional automotive focus, positioning robotics as a major growth engine even as ADAS remains a steady tailwind. The fourth-quarter robotics figure alone nearly matches the ADAS volume, highlighting a double-barreled shift: customers who once bought LiDARs primarily for cars are now equipping warehouses, autonomous shift-strategies in manufacturing, and autonomous service robots. In China’s crowded LiDAR space, scale matters, and RoboSense is stacking up unit volumes that make a profit forecast more plausible for the first time.

From a manufacturing perspective, the trajectory matters for global buyers. If robotics LiDAR sustains this pace, Chinese suppliers could become a more reliable backbone for industrial automation beyond automotive pilots. The 2025 data imply a maturing ecosystem where component makers, packaging houses, and system integrators align around robotics-focused LiDAR deployments. For international OEMs chasing automation workflows, RoboSense’s growth points to a more varied and potentially more price-competitive supply base, even as demand remains lumpy across regions and applications.

Two practitioner takeaways stand out. First, margins are already a meaningful story here. Robotics, as RoboSense suggests, can offer higher-margin opportunities than automotive LiDAR when deployed at scale in warehouses or robotic arms, because the unit economics improve with volume and diversified end-markets. A profit beacon in Q4 would be particularly meaningful if it survives the seasonality of year-end orders and the capital-heavy rollouts in logistics networks. Second, the supply chain is entering a phase where demand breadth—industrial robotics, service robots, and automation-as-a-service—could reduce cyclicality tied to car production alone. That diversification is a double-edged sword: it spreads risk but also intensifies competition among LiDAR suppliers, who now must prove reliability, calibration consistency, and long-term service across a broader customer base.

For policymakers and investors, RoboSense’s results illuminate a hopeful signal: China’s robotics and smart-manufacturing push appears to be translating into real, profits-on-the-books outcomes, not just rhetoric. For manufacturing executives evaluating sourcing, the lesson is clear: a growing robotics LiDAR ecosystem can be a meaningful strategic hedge against automotive demand cycles, provided the supply chain remains capable of sustaining rapid unit growth and the heavy lock-in of industrial automation deployments.

Sources

Newsletter

The Robotics Briefing

Weekly intelligence on automation, regulation, and investment trends - crafted for operators, researchers, and policy leaders.

No spam. Unsubscribe anytime. Read our privacy policy for details.